Lee Schafer: PolyMet tout

Please see the updates below —

It has been an especially glum time for the mining industry in recent months. Taconite (spellchecker offers masonite) plants are shuttered across northern Minnesota, and to add insult to injury, a new one, Essar Steel “Minnesota” is set to commence operations next year, financed in part with some $72 million in state funds, from DEED and the IRRRB. It turns out that “steel” is also a bit of a stretch in the name, since the company has backed away from building the promised steel plant, so it’ll just be Essar Taconite Minnesota in reality.

It would probably be fair to say that existing taconite producers are not happy about a new competitor, especially in the current low commodity prices environment, and especially when that competitor was given a leg up by the State of Minnesota (with some taconite production tax money paid by the existing producers, by the way). Moreover, it seems that Essar’s parent company, located in the city we used to call Bombay, is crosswise with the state on covenanted promises to build the steel plant contained in the financial deal. It’s an ugly word, but Essar is in default.

The CEO of Cliffs Natural Resources (just a comparative hop, skip and a jump away in Cleveland!), which has multiple facilities on the Range, has vowed to shutter one of its taconite production facilities permanently if Essar cough up so much as a pellet, saying that Essar would create a titanic oversupply of taconite.

Apparently, the governor and others had a video conference with the Essar CEO in Bombay about the problem and that the state wants its money back. You see, when you are a creditor, and the only way you can talk to your defaulting debtor is by video conference, well, the situation is not ideal.

With that 250 or so word preamble — a trifle for me, really — here’s what I really want to talk about: PolyMet and a recent column by the Dr. Pangloss of the local business press, Lee Schafer. It’s titled, Despite lower copper prices, PolyMet’s mine still has financial appeal. The web version of the story is dated October 15th.

It isn’t only the price of taconite pellets that’s been in steep decline; copper has been, too, as the headline intimates. Both PolyMet and Glencore’s (PolyMet’s sugar daddy) stock have nosedived in recent months and days.

According to Schafer, though, everything is fine. And he has two sources: PolyMet’s CEO Jon Cherry, and a company called Lake Street Capital Markets.

Well, okay then, Lee, Karin Housley can just put in that big buy order for PolyMet stock!

But the rest of you may want to consider Schafer’s sources.

CEO Cherry, reports Schafer, said that Glencore likes us; it really likes us! And we got another $6 million loan from Glencore.

Sadly, $6 million will only fund at most a few months of PolyMet’s office operations. Even if things go really, really well — which they won’t — that isn’t nearly enough money to get PolyMet to a mine, much less operate one. For that, it would need hundreds of millions of dollars. PolyMet can’t raise it, and Glencore’s shareholders and creditors probably won’t let it guarantee PolyMet’s financing, given Glencore’s balance sheet. In addition to the cost of operating a mine, there are the financial assurances that must be provided —up front — to the state.

It’s likely that PolyMet’s best play is to try to get a permit to mine and then be acquired by another mining major, the way Duluth Metals was (Duluth Metals was acquired; it doesn’t have a permit). The problem with this scenario is that other mining majors are in the same or a similar boat as Glencore.

Glencore’s $6 million is a band aid, one of those really little round ones.

There’s one other thing you need to know about CEO Jon Cherry’s blandishments. He probably doesn’t even believe them.

Here’s PolyMet’s stock chart for the last thirty days.

PolyMet 30-day stock price chart

Note a couple of things: the bump that the stock got at the time Lee Schafer’s article was published, but also note the big drop in the stock right at the beginning of October.

Although you wouldn’t know it from the Schafer piece, this corresponds with some heavy insider selling of PolyMet shares by, including, CEO Jon Cherry. On October 1st, CEO Cherry disposed of 195,750 shares or options to buy shares for 61 cents a share. (Recall also, that PolyMet’s largest shareholder and sugar daddy, had its own shares plummet to historic lows on September 28th.)

On October 1st, Jon Cherry sold a substantial portion of his shares or share rights in the company. When the shares were trading in the basement. Not exactly the conduct of a CEO confident of the future of his company: poised to get a permit to mine and to start operating one.

According to this linked report, most of the shares “sold” by Cherry on October 1st were “exercise[d] for cash.” In other words, rather than taking the shares and then selling them in a public market, he took the money out of the company till. The till of a company that had just gone begging to Glencore for $6 million to help keep the lights on.

But he was hardly the only insider selling shares at the time.

Over a couple of weeks leading up to October 1st, David Dreisinger, board member, disposed of a little over 258,000 shares; he acquired 28,726 shares pursuant to a stock option on October 2nd, but sold those shares immediately, too.

Officers Doug Newby, Brad Moore, and Stephanie Hunter, and multiple directors, too, sold many shares in the company right at the end of September, often dumping shares acquired from executive stock options in the market the same day, or a few days later (that’s what the board chair did, too), or exchanging them for the company’s cash, as CEO Cherry did.

The consequence of these actions was to diminish the cash of a company that needs it badly, and to depress the market for PolyMet shares.

Anyone who thinks these people are going to stick around and protect Minnesota’s environment and its patrimony of clean water is sadly mistaken. They don’t even protect their own shareholders.

But let’s also spend a moment considering Schafer’s other witness to the health of the PolyMet project, Lake Street Capital Markets. Schafer writes this:

Financial analysts who have looked at PolyMet don’t have to just stick with the company’s plan, of course. Chris Krueger of Minneapolis-based Lake Street Capital Markets assumes far lower metals prices in his financial model, but it still shows a consistently profitable operation with annual EBITDA of about $176 million.

“EBITDA” means earnings before interest payments, taxes, depreciation and amortization. EBITDA is kind of a measure of the cash that a business is expected to throw off from operations. We know that PolyMet will have to raise a half a billion dollars, in round numbers, to open a mine. [Maybe twice that, according to current estimates, 6/30/19.] That will obviously come at significant capital cost. It will also have to pay federal taxes, and state mining production and occupation taxes.

One of the other interesting things about Lake Street Capital Markets, though, is this, taken from a 2015 press release, linked above:

Lake Street Capital Markets, or its affiliates, intends to seek or expects to receive compensation for investment banking services from the subject issuer in the next three months.

The authoring analysts who are responsible for the preparation of this investment research are eligible for compensation based on the total revenue and general profitability of Lake Street Capital Markets, which includes investment banking revenue. However, such authoring analyst will not receive compensation that is directly based on or linked to specific investment banking transactions.

LSCM and its analysts have a direct financial interest in PolyMet, which is why it had to disclose that fact.

But just as in the case of the heavy PolyMet insider selling, Lee Schafer doesn’t mention this to his readers.

(For a more, well, sober judgment of PolyMet prospects, I recommend this recent article by Ed Lotterman in the Pioneer Press.)

This troubles me, frankly, and I think it ought to trouble you, too. It is difficult for the public to understand the nature and extent of the financial risks to the state and to the public without a genuine and accurate picture of whom we’re dealing with.

Update: The pixels were barely dry on this story when this went up at My Minnesota: Mining pollutes financial as well as natural environments. It included this observation:

Mining operations and companies are frequently structured to be not “too big to fail,” but to be able to “bail at fail” with government, the environment and locals trying to clean up the messes left behind.

Bingo.

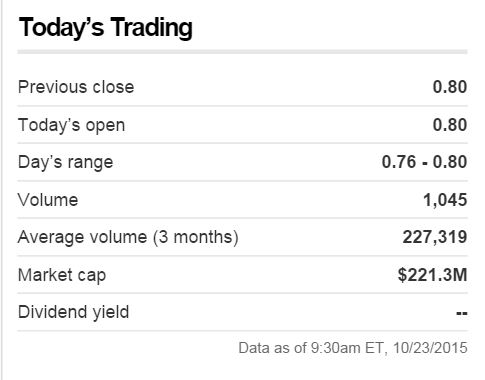

Update 10/23: Here’s a chart from CNN Money. It shows the average volume in shares of PolyMet over the last three months as about 227,00 shares/trading day. Compare that with the number of shares sold by just CEO Jon Cherry and board member David Dreisinger in a couple of days.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.